- (+91) 915 888 2688

- info@finxl.in

Investment Banking Training, Classes, Courses, Certification Program Online Live, Classroom in US

4 MONTHS

Completion Certificate

FINXL is leading investment banking training, courses, classes, certification in US. FINXL Certification program in Investment Banking is designed in such a way that required practical knowledge & exposure for learners to effectively deal with the various aspects of investment banking roles and responsibilities. Roles include Wealth management, asset management, Company valuations, security valuation like stocks & bonds to meet expected investment goals for the benefit of the investors. This Investment banking certification course in US caters to the functional areas of investment banking like mergers & acquisitions, Investment Banking, Portfolio Management, Investment advisory to Equity investors, Private equity, HNIs, UHINs.

The core role of Investment Bankers is raising capital (by issuing equity and debt of the company) for clients. The company which wants to raise fund by issuing bonds, need to hire an investment banker for structuring the bonds and then find potential investors to buy these bonds from its vast network. When a company raises capital by selling shares, or stocks (IPO), it's an investment banker who does book building (decide on share price) and then sells the company’s shares to big investors like mutual funds, insurance companies, asset management companies, UHNIs, etc.

Course Features

EXPERT SUPPORT

Online support from our team for all your queries based on ticket based tracking system

CERTIFICATION

Get 3 certifcations inone course financial modeling, equity research and advance excel. You can show them seperately in resume.

REAL TIME CASE STUDIES

Live case studies for each financial topics to ensure that learner can understand it thoroughly.

RESUME PREPARATION

Our expert will assist you in resume building and job portal updation.

LIFETIME ACCESS

You get lifetime access to the FINXL LMS which includes videos, excel spreadsheets, presentations, ebooks, quizzes and case studies.

FORUM

Our career square forum is ths most dynamic platform to connect with expert across the globe.

Introduction

Investment banking analyst program ensures maximum (around 80%) real-time working knowledge and skills of Investment Banking. The course will make learners in making informed and effective decisions in the areas of M&A, IPO’s, Valuation, Bond trading portfolio advisory services, etc., and hands-on knowledge and skills to become a successful Investment Banker.

To do our online Investment banking training, courses in US the learner does not necessarily require prior knowledge of finance, excel or accounting or to be from only a commerce background as our investment banking certification starts from basic, train everything from scratch. Anyone willing to learn and has Interest & appetite to learn the new skills set can do this course. By doing this course, learners can get jobs in core investment banking, Equity Research, Credit Analysis, Financial Analysis, Project Finance, Wealth Management, Financial Planning & Analysis, Portfolio Management, Capital Markets, etc.

Infect our online Investment banking certification in US designed in a way that learners can gain in-depth knowledge of concepts and real-life application of finance. Real-time live case studies help the learner to get real-time hands-on working exposure and become a readymade resource for any investment banking profile.

Our investment banking certification course in US is 90% practical and 10% theoretical. Learners do valuation of listed/Private/start-up companies with real-time company filings and latest available data. They get hands-on experience on forecasting of profit & loss account, income statement, statement of operations, Balance sheet, cash flow statement, fix assets schedules, debts schedules, debt revolver schedules, equity schedules, revenue drivers, cost drivers, sector, industry analysis and forecast, valuations like DCF, Relative valuation, Merger & Acquisition, LBO, Leverage buyout, etc. they also write detail Investment report which includes sector/industry analysis, Industry/sector/company drivers analysis, interpretation & forecasting, products/services analysis & forecasting. It also includes identifying potential growth prospects, risk factors, operations efficiency, financial liquidity & stabilities, returns on invested capital, investor returns forecast, recommendation on investment for long term/ short term, and which type of investors should invest to avoid any unforeseen losses.

At the end of the program, our assessment and presentation evaluation is similar to top Investment banking firms/companies and Investment banks. Our trainers will guide you thoroughly during the course to ensure you are learned properly and become ready to use resources for any global firm

FINXL Investment banking online course in US is designed in such a way that learner gets live online training with lifetime access to recorded sessions with 10 Investment banking reports with a focus on industry, sector, revenue and cost drivers, financial statement analysis & interpretation, future forecast, DCF & Relative valuations, peer analysis, ratios interpretation, SWOT analysis & recommendation, Exercises, spread sheets workings, etc. Our online Investment banking course is equipped with features like live placement assistance, Naukri portal updation, resume building, call scheduling, and mock interviews. One-on-one queries/doubts solving live sessions up to 5 hrs.

Where Investment Banking is used?

Investment banking is used in various business activities like Investment Banks, Investment banking firms, Credit Rating Agencies, Private Equity / Venture capitalists, Private & Public Banks, Consultancy Firms, and Corporate Finance Teams. The reason to prepare an Investment banking report is to analyse, interpret and explain reasons, logic, drivers, Economic, Sectorial, Industrial & Competitive scenarios which may play important role in Future Business Strategy & Operations. This helps to achieve the expected result with minimum deviations from its target and with risk-averse and mitigation solutions in hand. Investment banking requires skills like understanding, analysing & forecasting financial statements, ability to analyse & forecast Economics, Sectors, industries, and company’s products/services growth to make result-oriented investment decisions. They should have a vast investor network and the ability to crunch numbers quickly, smart enough to deal with clients and convince them for the right decision for their businesses.

Why FINXL?

FINXL Investment Banking program is designed in such a way that learner from other esteems like back-office operations, Finance operations, Account receivables, account payables, reconciliations, accounting, taxation, sales, marketing can change their domain to Investment banking by acquiring required knowledge and practical exposure from our investment banking course.

Professionals who are aspired to join as Investment banking analysts with or without prior exposure experience in the field can do this course and become a readymade resource for a job.

FINXL provide the best Investment banking Training Classes in US. Investment banking companies, Investment banks, and research firms don't entertain fresher’s due to the lack of minimum practical exposure required on the job. Hence, FINXL ensures learners to be experts, have hands-on working practical exposure on financial statement analysis & interpretation, detailed explanation on each financial model parameters, forecasting, valuation, and ready to use resource from day one at the job.

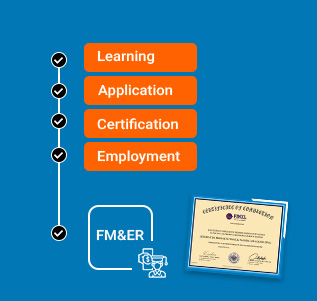

Course Highlights

- Certified Investment banking course with 100% Job Assistance

- 4 months Internship with Investment banking firm

- Real time technical interview preparation by Investment bankers

- Learn best Investment banking practices used in industry

- Build 5 Investment banking reports from scratch of your chosen listed companies

Why should you do Investment Banking?

Every finance professional dreamed to be an investment banker, as this professional draw a lot of attention towards very handsome salary, commissions, perks, quick professional & personal growth, networking etc.