Financial Planning & Analysis (FP&A)

4.5 MONTHS

3+ Year Experience in Any Field (MBA/PGDM Finance, CA, CFA, CS, CMA, M.Com, B.Com, BBA, BE, M.Tech, CIMA)

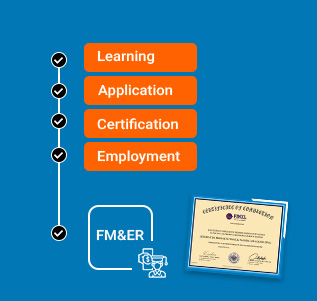

Get a Globally Accepted Certification

Our course is thoughfully designed in such a way that learner gets the Real Time Investment banking & Equity Research exposure. Learner is not necessarily be from finance background, as our course ensures that Basic finance & account concepts are covered in detail with real time examples.

It is 80% practical with industry used case studies.

Our assessment & presentation evaluations are similar to top investment banks & equity research firms Our expert trainers are on hand to help answer any questions you might have along the way.

Course Features

EXPERT SUPPORT

Online support from our team for all your queries based on ticket based tracking system

CERTIFICATION

Get 3 certifcations inone course financial modeling, equity research and advance excel. You can show them seperately in resume.

REAL TIME CASE STUDIES

Live case studies for each financial topics to ensure that learner can understand it thoroughly.

RESUME PREPARATION

Our expert will assist you in resume building and job portal updation.

LIFETIME ACCESS

You get lifetime access to the FINXL LMS which includes videos, excel spreadsheets, presentations, ebooks, quizzes and case studies.

FORUM

Our career square forum is ths most dynamic platform to connect with expert across the globe.

Introduction

In today's fast-paced business world, financial planning and analysis have become crucial for any organization's success. Financial Planning and Analysis (FP&A) is the process of analyzing an organization's financial performance and creating a forecast for the future. It helps businesses make informed decisions by providing insights into financial trends, risks, and opportunities.

Course Details

Course duration: Intensive 4.5 MONTHS

COURSE HIGHLIGHTS:

The #1 Course to Land a Job in Financial Planning & Analysis

Certified Financial Planning & Analysis Course with 100% Placement assistance

3/6 months internship with an Analytics firm

Gain hands-on, practical experience as you will work as an employee in a Financial Analytics firm along with training

80% of the Real-time industry used Case study-based learning

Our trainer: FP&A working professional

A guide to over 100+ frequently asked FP&A questions and their answers

Build 5 financial models from scratch of your chosen Listed/Private companies

Be part of our Global FP&A alumni network

Learn the best Planning, Budgeting, Forecasting, KPIs Analysis, Reporting & Presentation practices used in the industry

Prepare a company’s Budget from Scratch

Dedicated Placement Manager with 1-on-1 mentorship.

MODULE 1: MS EXCEL EXPERT

Excel Essentials & keyboard accelerators

Basic & advanced Excel functions

Conditional Formatting, Paste Special

Using VLOOKUP/HLOOKUP/ Match Index

Using SUMIF, COUNTIF, AND AVERAGEIF

DATEDIF, YEAR, YEARFRACE & MONTH

Index, Search, Choose, offset

Sensitivity analysis with Data tables

Pivot table, Charting commonly used

Dashboards, templates, Macros

MODULE 2: DATA COLLECTION AND MODELING

Sources for authentic financial data for US, India, China, Germany, and Singapore companies

Tricks to collect data in the shortest time

Data collection & Data structuring for model

Understanding of Financial Reports & their types

Types of filing 10-K, 10-Q, 8-K, 20-F etc

Create a Model template for 5 years of historical data for

Revenue Drivers

Cost Drivers

Income statement

Balance sheet

Cash flow statement

Dividend schedule

Asset Schedule

Debt Schedule

Equity Schedule

MODULE 3: FINANCE & ACCOUNTS CONCEPTS UNDERSTANDING

Finance principles and processes (e.g. financial management concepts, corporate finance activities, etc.)

General financial concepts and common financial formulas (e.g. time value, opportunity costs, debt structures and covenants, earnings per share, cost of capital, etc.)

Financial accounting concepts, principles, and practices

Interactions/ interrelationships of common financial statements

Basic microeconomics (e.g. marginal costs, pricing, price elasticity of supply and demand, etc.)

Managerial accounting/reporting and cost accounting concept

MODULE 4: FINANCIAL MODELING & VALUATIONS

Interlinking of financial statements (IS, BS, CFS)

Tallying the balance sheet in 30 minutes

Use best practices in Financial Model building

Understand & develop a forecasting basis for each line of IS, BS & CFS

Build & Forecast Advanced Schedules including the following points

Debt Repayment Schedule (DRS)

Fixed Assets Module (FAM)

Dividend & Equity Schedule (ES)

RATIOS:

In-depth conceptual understanding of financial ratios, we include the following points

Liquidity ratios

Leverage ratios

Efficiency ratios

Profitability ratios

Market value ratio

Calculation and analysis of ratios on your chosen company

Compare your company's ratios with competitors

DUPONT analysis

VALUATION:

(Understanding of various Valuation methods)

DISCOUNTED CASH FLOW (DCF)

In-depth step-by-step understanding of DCF

Product/business/economic life cycle concepts

Time value of money concepts

Understanding & calculation of FCFF & FCFE

Cost of Equity using the Capital Asset Pricing Model (CAPM)

Cost of Debt (Kd)

Cost of preference shares (Ke)

The risk-free rate of return (Rf) for listed & non-listed SMEs

In-depth analysis of systematic & unsystematic Risk

Beta, levered & Un-levered beta

Calculate beta(β) using the last 5 years' price

Cost of capital (WACC)

Market Premium (Rm)

Net present value /company value

Sensitivity analysis

Application of DCF on your chosen company

’Buy' or a 'Sell' rating based on analysis

MODULE 5: PLANNING

Getting Started with Financial Planning

The Accounting Framework

Financial modeling

Corporate financial planning/strategic planning

GATHERING & INTERPRETING INFORMATION

Sources of historical information and historical financial data and corporate structure and functions

Sources of information about a company's business environment (e.g. business models, financial ratios, and industry metrics)

Reading and interpreting corporate annual reports

Determining peer groups and competitors

Basic macro-economic concepts used in financial planning (e.g. consumer price index, gross domestic product, exchanges rates, interest rates, inflation rates, economic indicators, etc

Implications of tax policies on Projections

Risk Factors and risk management concept

Financial and non-financial key performance indicators (KPIs)

Strategic planning concepts and frameworks include the following points:

SWOT Analysis

Porter's five forces model

Growth share matrix

Determining information needs for and gathering information from internal/external stakeholders and business partners

Tools for information gathering (e.g. templates, surveys, etc.)

MODULE 6: FORECASTING

Perform Top-Down and Bottom-up Forecasting

Forecast a Company's Sales

Calculate Net Cash Flow

Forecast a Company's Planned Level of Production

Forecast Various Types of Expenditures

Estimate Working Capital Needs

Carry out a Fixed Asset Roll forward

Forecasting techniques (moving average, regression analysis, etc.)

Forecasting Selling, General & Administrative expenses

Essential Mechanics of the Forecasting Process

Forecasting Balance Sheet Items

MODULE 7: BUDGETING

Budgeting within a strategic framework

Building a robust budgeting process

A practical guide to developing budgets

Managing budget psychology

Common budgeting approaches (e.g. incremental value-based, zero-based, etc.)

Tracking budget performance with variance analysis (waterfall charts, etc.)

Applied budgeting tools and techniques (Excel, solver, pivot tables, etc.)

BUDGETING CONTROL

Meaning and objectives of budget and budgetary control, essentials of effective budgeting, types of budgets and budgets vs. actual

CAPITAL BUDGETING

Concept and process of capital budgeting, feasibility analysis, managing risk and certainty in capital budgeting, evaluation criteria under discounted and non-discounted cash flow approaches. Evaluate various investment decisions using appropriate tools and techniques and apply them to day-to-day business decisions.

MODULE 8: FINANCIAL ANALYSIS

Investment Decision making- Purpose, objective, and process of investment decisions and evaluation of different types of projects. The new line of business, expansion of the current product, backward/forward integration, and application of effective financial management.

Analysis of the balance sheet, app of appropriate measures for executing and evaluating the financial results to support managerial decision-making and setting strategies.

MODULE 9: REPORTING & PRESENTATION

Corporate Financial Reporting Attributes of good corporate financial reporting for performance analysis, understanding profit & loss items, reviewing the balance sheet, variance analysis, non-performing asset analysis, identifying the cause and taking appropriate action.

GLOBAL BANKING SPECIAL

Special guide on Global Banking KPIs

Basel III Financial structure (P&L account, balance sheet)

Restructuring items/adjustment items & their treatments

Additional information section

Key performance indicator (KPIs) - type of KPIs and its calculation & interpretation

Regulatory reporting

SEC reporting

FINMA reporting

MD&A (Management discussion & analysis)

Other external & internal reporting

MODULE 10: POWER BI

Power BI is a business analytics service provider by Microsoft. It provides interactive visualizations with self-service business intelligence capabilities, where end users can create reports and dashboards by themselves without having to depend on any information technology staff or data base administrator. Power BI certification course shares knowledge on how it provides cloud based BI services-known as Power BI Services, along with a desktop-based interface called Power BI Desktop. It offers data modeling capabilities including data preparations, data discovery, and inter active dashboards.

TOPICS COVERED:

Introduction to Power BI

Basic components of Power BI

Loading Data in Power BI Desktop

Data Cleaning using Power BI query editor

Transform, Clean, Shape and Model Data for further analysis.

Creating Calculated Columns and measures

Performing data analysis using DAX

Visualization Charts in Power BI

Slicers and Map Visualizations

Creating cards, measures, KPI, reference line, and slicers

Creating reports and dashboards

Publishing reports on Power BI Services

Using Power BI service for operations on reports

MODULE 11: PRESENTATION, REAL CASE STUDIES MOCK INTERVIEWS, SOFT SKILL

10 real time case studies

Prepare you on 100+ frequently asked FP&A Analyst interview questions with answers

Positive attitude and emotional intelligence training

Placement managers for 1 on 1 mentorship

Communication and interpersonal skills training

Conduct regular mock interviews

Work on individual strengths, and weaknesses and prepare an interview script

Profile building and marketing

Interview scheduling& helping candidates in placements

Pre-Requisites

Does basic knowledge of Finance / Accounting needed? Not required as we start from basics.

Does basic knowledge of Excel needed? Not required as we start from basics.

Does any Finance degree or Finance background required? Previous finance knowledge will help but not compulsory.

Target Audience

Any commerce Graduates & Post Graduates (BBA, BCOM, BBM, MCOM), Non-Commerce Graduate or Post Graduate (BSC, Engineers, B.E., B. Tech, M.E., After MBA OR During MBA, CFA or any degree in Finance, MBA/CFA/CA Aspirants, CPAs, ICWA, CS, Back office/operations working professionals, accounting working professionals, KPOs/BPOs professionals, Financial Analysts, Business Analysts, Start-up founders, Bankers, Financial Controllers, CFOs, CEOs, Fund Managers, PE Fund Managers, Account Receivables (AR), Accounts Payables (AP), Record To Report (R2R), Reconciliation background professionals, housewives after a long gap of marriage or kids to make a career in the Finance field, Businessman / Entrepreneur

Sales and Marketing skilled Individuals seeking a career change to the core finance domain

Research Companies

| > UBS | > Deloitte | > Deutsche Bank |

| > FIS | > BNP Paribas | > Honeywell |

| > Nomura | > J.P. Morgan | > Grand Thornton |

| > Syngenta | > TCS | > Transparent Value |

| > HSBC | > Bajaj Finserv | > Capgemini |

| > WNS Global | > Pitte | > Johnson Controls |

| > Elanco | > Spectra | > PKF Advisory |

| > Shore Infotech | > DSIJ | > Eversana |

| > Crisil | > Maersk | > BMC Software |

| > Reval Analytics | > Accenture | > Moody's Analytics |

| > Qualys | > Danfoss | > Veritas |

| > Daloopa | > EY | > Morningstar |

| > Citco | > KPMG | > Barclays |

| > TIAA | > Citicorp | > Tristone |

| > State Street | > Rocket Software | > Cognizant |

| > ZS Associates | > Mitcon Consultancy | > SG Analytics |

| > Credit Suisse | > Infosys | > Thomson Reuters |

| > Vodafone | > Force Motors | > Alcor Fund |

| > Wheaton Advisors | > Cians Analytics | > Dalal Street |

| > Morgan Stanley | > Aspera Advisors | > Genpact |