- (+91) 915 888 2688

- info@finxl.in

Financial Analyst Course, Classes, Training & Certification in Pune

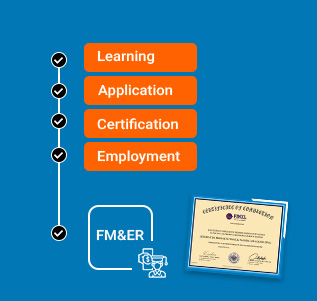

FINXL offers the Best Financial Analyst Course in Pune with 100% Placement support, designed for students, working professionals, and career switchers who want to enter core finance roles.

This industry-oriented Financial Analyst certification focuses on financial modeling, valuation, equity research, investment banking, FP&A, and Excel, with real-time case studies and live projects.

Whether you are a fresher or an experienced professional, FINXL’s Financial Analyst training in Pune prepares you for high-paying roles in Investment Banking, Corporate Finance, Private Equity, and Financial Planning & Analysis (FP&A).

Course Features

EXPERT SUPPORT

Online support from our team for all your queries based on ticket based tracking system

CERTIFICATION

Get 3 certifcations inone course financial modeling, equity research and advance excel. You can show them seperately in resume.

REAL TIME CASE STUDIES

Live case studies for each financial topics to ensure that learner can understand it thoroughly.

RESUME PREPARATION

Our expert will assist you in resume building and job portal updation.

LIFETIME ACCESS

You get lifetime access to the FINXL LMS which includes videos, excel spreadsheets, presentations, ebooks, quizzes and case studies.

FORUM

Our career square forum is ths most dynamic platform to connect with expert across the globe.

What is a Financial Analyst?

A financial analyst is a professional who analyses financial data, creates financial models, predicts future performance, evaluates investments, and assists with business and investment decisions.

Financial analysts are employed in a company's finance department or financial division. A financial analyst is an individual who acts as a link between raw numeric data and strategic business planning. Financial analysts work throughout many different industries ranging from banks to corporate finance departments to fintech companies and firms that provide consulting services and professional services.

Financial Analyst Course in Pune – Who Should Join?

- Commerce, Management & Engineering students

- MBA (Finance) graduates

- Working professionals in finance, accounting & banking

- CA / CMA / CFA aspirants

- Career switchers entering corporate finance

JOB ROLES AFTER FINANCIAL ANALYST COURSE

- Financial Analyst

- Investment Banking Analyst

- Equity Research Analyst

- Private Equity Analyst

- Portfolio Manager

- Wealth Manager

- Corporate Finance Analyst

- Budgeting & Forecasting Analyst

Learning Modes Available

- Classroom Training (Pune – Baner)

- Online Live Classes (Zoom)

- Recorded Sessions (Lifetime Access)

Financial Analyst Salary in Pune(2026)

Financial Analyst salaries in India vary based on experience, skills, domain, and the company you work for. Below is an average salary breakdown:

| Experience | Average Salary |

|---|---|

| Fresher | ₹4 – ₹7 LPA |

| 2–4 Years | ₹8 – ₹15 LPA |

| Senior Analyst | ₹18+ LPA |

Note: Salary depends on skills, domain expertise, location, and the organization.

What You Will Learn in FINXL’s Financial Analyst Course

MS EXCEL EXPERT

- Excel Essentials & keyboard accelerators

- Basic & advance excel functions

- Conditional Formatting, Paste Special

- Using VLOOKUP/HLOOKUP/ Match Index

- Using SUMIF, COUNTIF, AND AVERAGEIF

- DATEDIF, YEAR, YEARFRACE & MONTH

- Index, Search, Choose, offset

- Sensitivity analysis with Data tables

- Pivot table, Charting commonly used

- Dashboards, templates, Macros

DATA COLLECTION & MODELING

- Authentic sources of financial data for companies based in the United States, India, China, Germany and many more

- Tricks to collect data in the shortest time

- Data collection & Data structuring for model

- Understanding of Financial Reports & their types

- Types of filing 10-K, 10-Q, 8-K, 20-F etc.

- Create a Model template for 5 years of historical data for: - 1) Revenue Drivers, 2) Cost Drivers 3) Income statement 4) Balance sheet 5) Cash flow statement 6) Dividend schedule, 7) Asset Schedule, 8) Debt Schedule, 9) Equity Schedule

- Index, Search, Choose, offset

- Sensitivity analysis with Data tables

- Pivot table, Charting commonly used

- Dashboards, templates, Macros

FINANCE FUNDAMENTALS

- What Equity Research Analyst does?

- Skillset required for Equity Research Analyst?

- Job roles of BUY SIDE and SELL SIDE Analysts

- Understanding, Reading & Analyzing of: - Income statement, Balance sheet, Cash flow statements, Notes to accounts

- GAAP & Non-GAAP/Reported & Adjusted numbers

- Reported/Adjusted/GAAP/Non-GAAP EPS

- Restructuring & Adjusted numbers

- Pro-forma Income statement

- Restating financials for valuation and analysis

- Concepts & treatment of: Minority/Non-controlling, Associates, Subsidiary, Convertible debt/securities

- Corporate actions & their treatments Rights issue, Bonus issue, Takeover, Merger, Acquisitions, Stock splits, Spin-off, Reverse split

- 10+ case studies on live business

- Make business plans for startups

FINANCIAL MODELING & VALUATIONS

- Interlinking of financial statements (IS, BS,CFS)

- Tallying the balance sheet in 30 minutes

- Use best practices in Financial Model building

- Understand & develop a forecasting basis for each line of IS, BS & CFS

- Build& Forecast Advanced Schedules including the following points -> 1) Minority/Non-controlling 2) Associates 3) Subsidiary 4) Convertible debt/securities 5) Debt Repayment Schedule 6) Fixed Assets Module 7) Dividend & Equity Schedule

- RATIOS: In-depth conceptual understanding of financial ratios -> 1) Liquidity ratios 2) Leverage ratios 3) Efficiency ratios 4)Profitability ratios 5) Market value ratios

- Calculation and analysis of ratios on your chosen company

- Compare your company's ratios with competitors

- DuPont analysis

VALUATIONS

- DISCOUNTED CASH FLOW (DCF)

- RELATIVE VALUATION

- SUM OF THE PARTS ANALYSIS(SOTP)

- DDM (DIVIDEND DISCOUNT MODEL)/ (GORDON GROWTH MODEL)

Mergers and Acquisitions (M&A)

- LEVERAGED BUYOUTS

- RELATIVE VALUATION

- LBO ANALYSIS

- MERGER & ACQUISITIONS

- BUY-SIDE

- IPO

- PITCHBOOK

- REGULATORS & MARKET REQUIREMENT:

FINANCIAL PLANNING & ANALYSIS

- GATHERING & INTERPRETING INFORMATION

- SWOT ANALYSIS

- FINANCIAL FORECASTING

- FINANCIAL BUDGETING

- BUDGETING CONTROL

- CAPITAL BUDGETING

- FINANCIAL ANALYSIS

- REPORTING & PRESENTATION

- POWER BI

Why FINXL is the Best Financial Analyst Course in Pune

- The No.1 Course in Pune to Land a Job in Financial Analyst

- An Industry recognized Certified Financial Analyst Course with a 100% Placement GUARANTEE

- 12-month on job training program with a financial research company

- Gain hands-on, practical experience during training, similar to a real job within the Financial Research Bank

- 80% of the Real-time industry used Case study-based learning

- Our trainers: Investment Banking working professionals with 15+ years of Experience

- A guide to over 100 frequently asked Financial Analyst questions and their answers

- Build 15 financial models from scratch of your chosen Listed/Private companies

- Dedicated trainer for soft skills & interview preparation

- Be part of our Global Financial Analyst alumni network

- Dedicated Placement Manager with 1-on-1 mentorship

Best Financial Analyst Training Institute in Pune

Financial Analyst Course in Pune with Placement ensures maximum (around 80%) real-time working knowledge and skills pertaining to Financial Analyst. The course will make learners in making informed and effective decisions in the areas of Equity Research, Financial Planning & Analysis, Valuations, Forecasting, Budgeting, Planning, M&A, IPO’s, Bond trading portfolio advisory services, etc., and hands-on knowledge and skills to become successful Financial Analyst.

Financial Analyst Training Institute in Pune, the learner does not necessarily require prior knowledge of finance, excel or accounting or to be from only a commerce background as our financial analysis certification start from basic, train everything from scratch. Anyone willing to learn and has Interest & appetite to learn the new skills set can do this course. By doing this course, learners can get jobs in core Financial Analyst, Equity Research, Credit Analysis, Financial Analyst, Project Finance, Wealth Management, Financial Planning & Analysis, Portfolio Management, Capital Markets, etc.

Infect our online Financial Analyst classes in Pune designed in a way that learners can gain in-depth knowledge of concepts and real-life application of finance. Real-time live case studies help the learner to get real-time hands-on working exposure and become a readymade resource for any Financial Analyst profile.

Our Financial Analyst certification course in Pune is 90% practical and 10% theoretical. Learners do valuation of listed/Private/start-up companies with real-time company filings and latest available data. They get hands-on experience on forecasting of profit & loss account, income statement, statement of operations, Balance sheet, cash flow statement, fix assets schedules, debts schedules, debt revolver schedules, equity schedules, revenue drivers, cost drivers, sector, industry analysis and forecast, valuations like DCF, Relative valuation, Merger & Acquisition, LBO, Leverage buyout, etc. they also write detail Investment report which includes sector/industry analysis, Industry/sector/company drivers analysis, interpretation & forecasting, products/services analysis & forecasting. It also includes identifying potential growth prospects, risk factors, operations efficiency, financial liquidity & stabilities, returns on invested capital, investor returns forecast, recommendation on investment for long term/ short term, and which type of investors should invest to avoid any unforeseen losses.

At the end of the program, our assessment and presentation evaluation is similar to top Financial Analyst firms/companies and Investment banks. Our trainers will guide you thoroughly during the course to ensure you are learned properly and become ready to use resources for any global firm

FINXL 100% Placement Financial Analyst Course in pune is designed in such a way that learner gets live online training with lifetime access to recorded sessions with 20 Financial Models, M&A Models, research reports, Investment report, Business Models, Project report, Funding reports, equity raising models, with focus on industry, sector, revenue and cost drivers, financial statement analysis & interpretation, future forecast, DCF & Relative valuations, peer analysis, ratios interpretation, SWOT analysis & recommendation, Exercises, spread sheets workings, etc. Our online financial analysis course is equipped with features like live placement assistance, Naukri portal updation, resume building, call scheduling, and mock interviews. One-on-one queries/doubts solving live sessions up to 15 hrs.

Financial Analyst Skills & Career Opportunities Across Finance Domains

Financial Analyst skills are used in various finance domains like Investment Banks, Financial Analyst firms, Credit Rating Agencies, Private Equity / Venture capitalists, Private & Public Banks, Consultancy Firms, Corporate Finance Teams, Financial planning & analysis, financial budgeting, forecasting. The reason to prepare Financial Models & reports is to analyse, interpret and explain reasons, logic, drivers, Economic, Sectorial, Industrial & Competitive scenarios which may play important role in Future Business Strategy & Operations and smooth commercial decision-making by management of the company. This helps to achieve expected results with minimum deviations from its target and with risk-averse and mitigation solutions in hand. Financial Analyst requires skills like understanding, analysing& forecasting financial statements, ability to analyse& forecast Economics, Sectors, industries, and company’s products/services growth to make result-oriented investment decisions. They should have a vast investor network and the ability to crunch numbers quickly, smart enough to deal with clients and convince them for the right decision for their businesses.

Why Choose FINXL for Financial Analyst Training in Pune?

FINXL Financial Analyst program is designed in such a way that learner from other esteems like back-office operations, Finance operations, Account receivables, account payables, reconciliations, accounting, taxation, sales, marketing can change their domain to Core Finance domain by acquiring required knowledge and practical exposure from our Financial Analyst course.

Professionals who are aspired to join in Financial Analyst with or without prior exposure experience in the field can do this course and become readymade resources for a job.

FINXL provide the best Financial Analyst trainingclasses in Pune Maharashtra India. Financial Analyst companies, Investment banks, financial planning & analysis companies, valuation companies and research firms don't entertain fresher's due to lack of minimum practical exposure required on job. Hence, FINXL ensures learner to be expert, have hands on working practical exposure on financial statement analysis & interpretation, details explanation on each financial modelling parameters, M&A, Investment banking parameters, financial planning & analysis, forecasting, valuation and ready to use resource from day one at job.

why should you pursue a career in Financial Analyst?

A Financial Analyst evaluates historical financial data, identifies trends, analyzes market drivers, and forecasts future performance to help organizations make data-driven investment and business decisions.

Financial Analysts play a critical role in:

- Capital raising (Equity & Debt)

- IPO pricing & book building

- Mergers & Acquisitions

- Portfolio & fund management

- Corporate budgeting & forecasting

- Valuation of listed, private & startup companies

Career Possibilities from Enrolling in a Financial Analyst Course There are many diverse careers available to those graduating from a financial analyst program. These career choices may include financial analyst, financial planning and analysis analyst, investment banking or portfolio management and corporate strategy. As the technical abilities and forecasting capabilities of the Financial Analyst continue to increase and diversify, the Financial Analyst career path continues to grow internationally.

In the current economic climate, companies must employ trained financial managers who can collate and analyze sufficient financial data to develop growth plans for their companies.

Benefits of Financial Analyst Certification

Career Opportunity: Most certified financial analysts receive higher compensation than non-certified financial analysts.

Verification of Advanced Skills:The certification is a validating document, confirming the completion of coursework covering valuation, modeling, forecasting, and technical analysis.

Recognition by Employers:Employers are actively looking for individuals who have earned certified financial analyst certifications, which places pressure on employers to find the best qualified candidates.

A certification earned through financial analysis training, will provide numerous advantages for individuals seeking to establish a career in core finance

What Makes FINXL the Best Financial Analyst Course in Pune

Join our Best Financial Analyst Certification with 100% Job Guarantee in Corporate Finance. Gain expertise in financial analysis, valuation, and budgeting. Develop skills in Excel, data analysis tools, and financial software. Benefit from real-world simulations and networking opportunities. Our career services team ensures personalized support for resume building, interview preparation, and job placement. Launch your successful career as a financial analyst in just a few weeks. Take the first step today!

FINXL’s Best Financial Analyst Training in Pune designed to help those just starting out in Finance get ready for the finance industry. This Programme is different to other Certifications as it focuses on practical financial modelling, valuation in the real world as well as practical Equity Research, which are essential skills that all Employers will look for in Finance Roles today.

This Program trains its students in their thinking and performance styles to develop their skills as a Financial Analyst for Investment Banking, Equity Research, FP&A, and Corporate Finance.

- End-to-End Financial Modeling:

1) Create a Comprehensive Financial Model with 3 Components - 3 Statement

2) Forecast revenue, establish cost drivers and working capital requirements, schedule debt payments

3) Perform sensitivity and scenario analysis - Valuation & Investment Analysis

1) Model for business and investment decisions

2) Discounted Cash Flow (DCF)

3) Relative valuation (Multiples) - Equity Research & Analyst Framework:

1) Conduct a company analysis and assess its financial health for investment purposes

2) Forecast revenue, establish cost drivers and working capital requirements, schedule debt payments

3) Perform sensitivity and scenario analysis - Practical Skills Based Training:

Models are built during live projects, working for a listed company in an industry known, case study, working like an analyst / financial analyst

- Career Placement Assistance:

1) Mock interviews for Financial Analyst positions

2) Provide placement assistance to all students that helps to get job in core finance companies

3) Resume & LinkedIn optimization

FAQs

1. What is FINXL?FINXL is a leading corporate finance institute offering global training in core finance domains like Advanced Excel, Financial Modeling, Equity Research, Investment Banking, Financial Analyst, Financial Planning & Analysis (FP&A), Startup Valuation, Power BI, NISM Courses and many more.

2. Who are the trainers at FINXL?FINXL trainers are seasoned finance professionals with real-world experience in Equity Research and Investment Banking.

3. Does FINXL offer placement assistance?Yes, FINXL provides dedicated placement managers and 1-on-1 mentorship to help learners secure jobs in top companies.

4. How do I enroll in a FINXL course?You can enroll through the FINXL website or contact us directly.

5. Can I join multiple courses at once?Yes, but we recommend focusing on one course for better outcomes.

6. Do courses include assignments?Yes, assignments and projects are part of every course.

7. Is support available during the course?Yes, FINXL provides technical and academic support.

8. How are the courses delivered?FINXL offers courses in three modes of delivery to suit diverse learning preferences:

- Classroom Mode: In-person training sessions at designated centers along with Online Live & recorded content access too, providing hands-on guidance and interaction with instructors and peers.

- Online Live Mode: Interactive live sessions conducted via Zoom, allowing learners to participate in real-time from anywhere along with recorded content.

- Pre-recorded Mode: Access to non-downloadable recorded content, enabling self-paced learning with flexibility.

9. Does FINXL provide internships?Yes, internships with Equity Research & Investment Banking firms are included in many courses.

10. How is placement support provided?Through mock interviews, profile building, and placement scheduling.

11. Do I need prior experience for placement?No, FINXL training prepares you for finance roles from scratch.

12. Can I get help with resume building?Yes, resume crafting is part of our placement services.

13. What roles do FINXL graduates secure?Roles include Financial Analyst, Investment Banking, Equity Research Analyst, FP&A Analyst, Equity Research Analyst, Finance Manager, Business Analyst, Consultant, Finance Executive, M&A and Private Equity.

14. What is the eligibility for job assurance?Candidates must meet attendance, assignment, and assessment criteria.

15. How many interviews are guaranteed?FINXL provides 5–10 interview opportunities within 6 months of course completion.

16. Are job placements available outside India?Currently, placements are offered across India.

17. What if I fail the mock interviews?You can reattempt after addressing feedback.

18. How do I contact FINXL for queries?You can reach us through our website (www.finxl.in) , email (info@finxl.in) , or phone (+91 81091 30909/ +91 96616 26371/+91 91588 82688.