- (+91) 915 888 2688

- info@finxl.in

Financial Forecasting Online Training, Classes, Courses, Certification Program Online Live, Classroom in UK

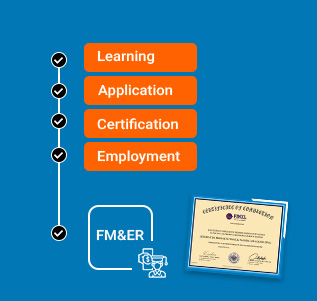

4 MONTHS

Completion Certificate

FINXL is the leading online financial forecasting training, classes, courses, certification in UK. Forecasting is very critical for financial modelling, equity research, fundamental analysis, investment banking, valuations, financial planning & analysis, FP&A, strategic forecasting, etc. There are various types of forecasting methods like Straight line, Moving average, simple linear regression, multiple linear regression. Depending on the requirement, one of the above methods will be used. Different methods will be used in forecasting different items from financial statements. As a financial analyst, professional needs to forecast sales forecasting, operating expenses forecasting, working capital forecasting, capital expenditure forecasting, cash flow requirement forecasting. Forecasting can be done by using the following approaches like Qualitative techniques, Time series, and projection, Casual models. Forecasting is generally done on a short-term basis to ensure that forecasted numbers are in line with actual results. Forecasting can be done on a weekly basis, monthly bases, quarterly basis, and annual basis. Every FP&A analyst dream to be a part of the financial forecasting team as this great sense of future forecasting of industry, sector, and how its impact is company-specific in a given period of time. Our Financial forecasting Training certification program is thoughtfully designed in such a way that Lerner gets the real-time maximum practical exposure in Financial Planning, Budgeting, Forecasting, Key Performance Indicators analysis, External reporting, Internal management reporting.

Course Features

EXPERT SUPPORT

Online support from our team for all your queries based on ticket based tracking system

CERTIFICATION

Get 3 certifcations inone course financial modeling, equity research and advance excel. You can show them seperately in resume.

REAL TIME CASE STUDIES

Live case studies for each financial topics to ensure that learner can understand it thoroughly.

RESUME PREPARATION

Our expert will assist you in resume building and job portal updation.

LIFETIME ACCESS

You get lifetime access to the FINXL LMS which includes videos, excel spreadsheets, presentations, ebooks, quizzes and case studies.

FORUM

Our career square forum is ths most dynamic platform to connect with expert across the globe.

Introduction

To do our online financial forecasting Training in UK, the learner does not necessarily require prior knowledge of finance, excel, or accounting as our financial forecasting Training online ensures that basic financial forecasting rules, methods, approaches on various industries and sectors are covered in detail with live real-time examples.

Our financial forecasting training, certification, course in UK is 90% practical and 10% theoretical. The learner gets hands-on experience in various type of forecasting, do forecasting on very small businesses, mid-level and private companies. Forecasting is one of the important profiles in financial planning & analysis, FP&A. Top-down forecasting or bottom-up forecasting approaches are used generally for sales forecasts.

Our Certification in Financial forecasting course in UK will cover forecasting for various business sectors and industries like bank reports, oil & gas company reports, manufacturing reports, TMT sector companies report, etc. Forecasting gives real-time decision-making capabilities to management, it is so important to manage funds, resources, working capital and avoid any unforeseen situation. Forecasting also prepares management to deal with any adverse situation in the coming years to ensure sustainable business, continuous growth, and value creation to shareholders. Financial forecasting also enables management’s decisions in direction to achieve the company’s strategic goal and long-term sustainability and value creation to shareholders. Also, reports ensure to Identify potential growth prospects, risk factors, operations efficiency, financial liquidity & stabilities, returns on invested capital. This all is important for management to take thoughtful decisions for sustainable business growth and create wealth for shareholders in long term.

The financial forecasting Training program also includes financial modeling, equity research, valuation, investment banking domains as well.

At the end of the program, our assessment and presentation evaluation is similar to top financial forecasting Training firms/companies and corporate finance companies, Global Banks, IT & Manufacturing companies. Our trainers will guide you thoroughly during the course to ensure you are learning properly and become ready to use resources for any global firm.

FINXL financial forecasting training online course in UK is designed in such a way that learner gets live online training with lifetime access to recorded sessions with 10 companies’ budgets, plans, forecasts, KPIs sheets, and regulatory reports, external reports and MIS reports. Our online financial forecasting Training course is equipped with features like live placement assistance, Naukri portal updation, resume building, call scheduling, and mock interviews. One-on-one queries/doubts solving live sessions up to 5 hrs.

Where Financial forecasting Training is used?

Financial forecasting Training in UK is used in various business activities like Financial Planning, Budgeting, Forecasting, strategic decision making, analysing business operations, headcount analysis, project financing, capex/capital expenditure, working capital, liquidity, return on invested capital need. This gives a tool to management to arrange required future resources to run the business smoothly. The majority of FP&A roles are open in Asset management banks, commercial banks, wealth management banks, Investment Banks, Private Equity / Venture capitalists, Private & Public Banks, Consultancy Firms, and Corporate Finance Teams. The reason to do financial forecasting Training is to prepare a financial plan to ensure that we are ready for upcoming challenges and mitigate them with available options. This helps management to analyse, interpret and explain reasons, logic, drivers, Economic, Sectorial, Industrial & Competitive scenarios which may play important role in Future Business Strategy & Operations. This helps to achieve the expected results with minimum deviations from its target and with risk-averse and mitigation solutions in hand. Financial forecasting Training requires skills like understanding, analysing & forecasting financial statements, ability to analyse & forecast Economics, Sectors, industries, company’s products/services growth, identify strength or USP to tab on opportunities to make result-oriented investment decisions. The type of budgets we use during training is zero-based budgeting, value proposition budgeting, activity-based budgeting, incremental budgeting. For a company, we prepare a cash flow budget, operating expenses budget, financial budget, sales budget, production budget, overheads budget, personal budget, marketing budget, static budget, master budget, etc.

Why FINXL?

FINXL provide the best financial forecasting training classes in UK. Companies like Investment banks, wealth management companies, asset management companies, manufacturing companies, IT & ITES companies don't entertain fresher’s for financial forecasting Training profile due to lack of minimum practical exposure required on job. As this role is considered very crucial and full of responsibilities and hence require unique, particular set of skills to drive the organisation in growth direction. Professional will play role of planner, strategist, and connector within different department of a company. So how to acquire such skills and fit into requirement, here FINXL FP&A fully practical program comes into picture and ensures learner to be expert, have hands on working practical exposure on financial statement analysis & interpretation, details explanation on each financial model parameters, forecasting, valuation and ready to use resource from day one at job.

FINXL FP&A program is designed in such a way that learner from other esteems like back-office operations, Finance operations, Account receivables, account payables, reconciliations, accounting, taxation, sales, marketing can change their domain to financial forecasting Training, FP&A by acquiring required knowledge and practical exposure from our Financial forecasting Training, course in UK.