- (+91) 915 888 2688

- info@finxl.in

Financial Analysis Training, Classes, Courses, Certification Program Online Live, Classroom in UAE

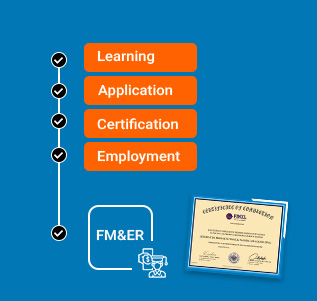

4 MONTHS

Completion Certificate

FINXL is leading financial analysis training, classes, courses in Pune, Maharashtra, India. FINXL Certification program in financial analysis is designed in such a way that required practical knowledge & exposure for learners to effectively deal with the various aspects of financial analysis roles and responsibilities. Roles include financial analysis, Investment Banker, buy-side Equity research analyst, sell-side Equity research analyst, Private equity analyst, Fund manager, portfolio manager, Financial Planning, Budgeting, Forecasting Analyst, Wealth manager, Fundamental Analyst. This Financial analysis certification course caters to the functional areas of financial analysis like Merger & Acquisition, Financial Analysis, Portfolio Management, Investment advisory to Equity investors, Private equity, HNIs, UHINs.

The core role of financial analysis digs into past, analyse the trends, drivers, current market trend, and how they may impact the company’s current investment in the future. This allows management to make well-informed decisions and utilize resources to get the best commercial outcomes. Also raising capital (by issuing equity and debt of the company) for clients. The company which wants to raise fund by issuing bonds, need to hire an investment banker or financial analysis for structuring the bonds and then find potential investors to buy these bonds from its vast network. When a company raises capital by selling shares, or stocks (IPO), its investment banker who do book building (decide on share price) and then sells the company’s shares to big investors like mutual funds, insurance companies, asset management companies, UHNIs, etc.

Course Features

EXPERT SUPPORT

Online support from our team for all your queries based on ticket based tracking system

CERTIFICATION

Get 3 certifcations inone course financial modeling, equity research and advance excel. You can show them seperately in resume.

REAL TIME CASE STUDIES

Live case studies for each financial topics to ensure that learner can understand it thoroughly.

RESUME PREPARATION

Our expert will assist you in resume building and job portal updation.

LIFETIME ACCESS

You get lifetime access to the FINXL LMS which includes videos, excel spreadsheets, presentations, ebooks, quizzes and case studies.

FORUM

Our career square forum is ths most dynamic platform to connect with expert across the globe.

Introduction

Financial analysis program ensures maximum (around 80%) real-time working knowledge and skills pertaining to financial analysis. The course will make learners in making informed and effective decisions in the areas of Equity Research, Financial Planning & Analysis, Valuations, Forecasting, Budgeting, Planning, M&A, IPO’s, Bond trading portfolio advisory services, etc., and hands-on knowledge and skills to become successful financial analysis.

To do our online financial analysis training in UAE, the learner does not necessarily require prior knowledge of finance, excel or accounting or to be from only a commerce background as our financial analysis certification start from basic, train everything from scratch. Anyone willing to learn and has Interest & appetite to learn the new skills set can do this course. By doing this course, learners can get jobs in core financial analysis, Equity Research, Credit Analysis, Financial Analysis, Project Finance, Wealth Management, Financial Planning & Analysis, Portfolio Management, Capital Markets, etc.

Infect our online financial analysis classes in UAE designed in a way that learners can gain in-depth knowledge of concepts and real-life application of finance. Real-time live case studies help the learner to get real-time hands-on working exposure and become a readymade resource for any financial analysis profile.

Our Financial analysis certification course in UAE is 90% practical and 10% theoretical. Learners do valuation of listed/Private/start-up companies with real-time company filings and latest available data. They get hands-on experience on forecasting of profit & loss account, income statement, statement of operations, Balance sheet, cash flow statement, fix assets schedules, debts schedules, debt revolver schedules, equity schedules, revenue drivers, cost drivers, sector, industry analysis and forecast, valuations like DCF, Relative valuation, Merger & Acquisition, LBO, Leverage buyout, etc. they also write detail Investment report which includes sector/industry analysis, Industry/sector/company drivers analysis, interpretation & forecasting, products/services analysis & forecasting. It also includes identifying potential growth prospects, risk factors, operations efficiency, financial liquidity & stabilities, returns on invested capital, investor returns forecast, recommendation on investment for long term/ short term, and which type of investors should invest to avoid any unforeseen losses.

At the end of the program, our assessment and presentation evaluation is similar to top financial analysis firms/companies and Investment banks. Our trainers will guide you thoroughly during the course to ensure you are learned properly and become ready to use resources for any global firm

FINXL Financial analysis online course in UAE is designed in such a way that learner gets live online training with lifetime access to recorded sessions with 20 Financial Models, M&A Models, research reports, Investment report, Business Models, Project report, Funding reports, equity raising models, with focus on industry, sector, revenue and cost drivers, financial statement analysis & interpretation, future forecast, DCF & Relative valuations, peer analysis, ratios interpretation, SWOT analysis & recommendation, Exercises, spread sheets workings, etc. Our online financial analysis course is equipped with features like live placement assistance, NaUAEri portal updation, resume building, call scheduling, and mock interviews. One-on-one queries/doubts solving live sessions up to 15 hrs.

Where Financial Analysis be used?

Financial Analysis skills are used in various finance domains like Investment Banks, Financial analysis firms, Credit Rating Agencies, Private Equity / Venture capitalists, Private & Public Banks, Consultancy Firms, Corporate Finance Teams, Financial planning & analysis, financial budgeting, forecasting. The reason to prepare Financial Models & reports is to analyse, interpret and explain reasons, logic, drivers, Economic, Sectorial, Industrial & Competitive scenarios which may play important role in Future Business Strategy & Operations and smooth commercial decision-making by management of the company. This helps to achieve expected results with minimum deviations from its target and with risk-averse and mitigation solutions in hand. Financial analysis requires skills like understanding, analysing& forecasting financial statements, ability to analyse& forecast Economics, Sectors, industries, and company’s products/services growth to make result-oriented investment decisions. They should have a vast investor network and the ability to crunch numbers quickly, smart enough to deal with clients and convince them for the right decision for their businesses.

Why FINXL?

FINXL Financial analysis program is designed in such a way that learner from other esteems like back-office operations, Finance operations, Account receivables, account payables, reconciliations, accounting, taxation, sales, marketing can change their domain to Core Finance domain by acquiring required knowledge and practical exposure from our Financial analysis course.

Professionals who are aspired to join in financial analysis with or without prior exposure experience in the field can do this course and become readymade resources for a job.

FINXL provide the best financial analysis trainingclasses in UAE. financial analysis companies, Investment banks, financial planning & analysis companies, valuation companies and research firms don't entertain fresher's due to lack of minimum practical exposure required on job. Hence, FINXL ensures learner to be expert, have hands on working practical exposure on financial statement analysis & interpretation, details explanation on each financial modelling parameters, M&A, Investment banking parameters, financial planning & analysis, forecasting, valuation and ready to use resource from day one at job.

Course Highlights

- Certified Financial analysis course with 100% Job Assistance

- 4 months Internship as a Financial analysis in equity research firm

- Real time technical interview preparation by Investment bankers

- Learn best financial analysis practices used in industry

- Build 15 Financial models, business models, reports from scratch of your chosen listed companies

- Learn 'reading of any listed Indian company financials in 10 minutes

- Be part of our vast financial analysis alumni network

Why should you do Financial Analysis?

Every finance professional dreamed to be a financial analysis in top notch global firms, as this professional draw a lot of attention towards very handsome salary, commissions, perks, quick professional & personal growth, networking etc.