- (+91) 915 888 2688

- info@finxl.in

Financial Modelling Training, Courses, Classes, Certification Program Online Live, Classroom

4 MONTHS

Completion Certificate

FINXL is a leading financial modelling training, course, classes, valuation training provider. Our Financial Modelling certification program is thoughtfully designed in such a way that Lerner gets the real-time maximum practical exposure in Financial Model building on any chosen global company. Learners build models from scratch.

To do our live financial modelling training online, learner do not necessarily requires prior knowledge of finance, excel or accounting as our financial modeling training online ensure that basic finance, accounting, excel are covered in detail with live real-time examples.

Our financial modelling certification, course is 90% practical and 10% theoretical. The learner builds real-time financial models on live listed/Private/start-up companies with real-time company filings and the latest available data. You get hands-on experience on forecasting of profit & loss account, income statement, statement of operations, balance sheet, cash flow statement, fix assets schedules, debts schedules, debt revolver schedules, equity schedules, revenue drivers, cost drivers, sector, industry analysis and forecast, valuations like DCF, Relative valuation, etc.

Course Features

EXPERT SUPPORT

Online support from our team for all your queries based on ticket based tracking system

CERTIFICATION

Get 3 certifcations inone course financial modeling, equity research and advance excel. You can show them seperately in resume.

REAL TIME CASE STUDIES

Live case studies for each financial topics to ensure that learner can understand it thoroughly.

RESUME PREPARATION

Our expert will assist you in resume building and job portal updation.

LIFETIME ACCESS

You get lifetime access to the FINXL LMS which includes videos, excel spreadsheets, presentations, ebooks, quizzes and case studies.

FORUM

Our career square forum is ths most dynamic platform to connect with expert across the globe.

Introduction

Historical data collection on global companies, data analysis, data modelling, formula building and scheduling also included in our financial modelling program.

At the end of the program, our assessment and presentation evaluation is similar to top financial modelling companies and Investment banks. Our trainers will guide you thoroughly during the course to ensure you are learning properly and become ready to use resources for any global firm.

FINXL financial Modelling online course is designed in such a way that learner gets live online training with lifetime access to recorded sessions with 10 Financial Models & Research reports, content, spreadsheets, etc. Our online financial modelling course is equipped with features like live placement assistance, Naukri portal updation, resume building, call scheduling, and mock interviews. One-on-one queries/doubts solving live sessions up to 5 hrs.

Where Financial Modelling is used?

Financial modelling is used in various business activities like Investment Banks, Equity Research firms, Credit Rating Agencies, Private Equity / Venture capitalists, Private & Public Banks, Consultancy Firms, and Corporate Finance Teams. The reason to prepare financial models is to translate Future Business strategies & Operations into realistic numbers taking into account the impact of Economic, Sectorial, and Industrial & Competitive scenarios. Financial modeling requires skills like hands-on working experience in Excel, understanding, analyzing & forecasting of financial statements, ability to analyze Economics, Sector Knowledge, and Business Strategy. Equity Research firms provide detailed research & insights into an economy, sector, company which forms the basis of investment decisions.

Why FINXL?

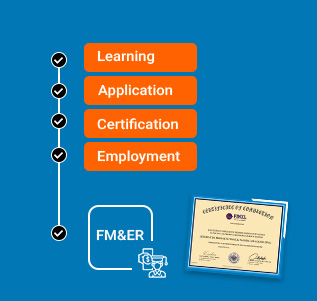

Financial Modelling Course. Financial Modelling companies, Investment banks don't entertain fresher's due to lack of minimum practical exposure required on job. Hence, FINXL ensures learners to be experts, have hands-on working practical exposure on financial model building, forecasting, valuation, and ready use resources from day one at the job.

FINXL Financial Modelling Certification is designed in such a way that learner from other esteems like back-office operations, Finance operations, Account receivables, account payables, reconciliations, accounting, taxation, sales, marketing can change their domain to core financial modelling field by acquiring required knowledge and practical exposure from our financial modelling course.

Professionals who are aspired to join the financial modelling analyst with or without prior exposure experience in the field can do this course and become readymade resources for a job.

Course Highlights

- Certified financialmodelling course with 100% Job Assistance

- 4 months Internship with Equity Research firm

- Real-time technical interview preparation by Investment bankers

- Learn best Financial Modelling practices used in the industry

- Build 5 Financial Models from scratch of your chosen listed company

- Learn 'reading of any listed Indian company financials in 10 minutes

Why should you do Financial Modelling?

Financial Modeling is the most important and un-avoidable skillset in finance domains like Financial Modelling, equity research, investment banking, corporate finance, valuations, private equity, and venture capital. Anyone who is willing to read, understand and analyses financial data, convert numbers in the explanation, convert given information into numbers, projection of financial information, value the businesses, companies, investment in Shares.